The Good, The Bad & The Ugly: A look at the second half of 2024

Brandt School Senior Fellow Henning Gloystein provides an insightful outlook on global political and economic trends for the second half of this year. Note by the editor: the article was written prior to the French election.

The Good

As the half-year point of 2024 approaches, some of the more negative concerns that were looming at the start of the year have not materialized, at least yet.

For starters, the US economy has not stalled or fallen into recession, as many economists believed it would by midyear. While its GDP growth rate has slowed from a strong 4.9% and 3.4% in Q3 and Q4 of 2023, to just 1.3% during the first three months of this year, fears of a recession have so far not materialized, largely thanks to ongoing healthy household consumption as well as investments incentivized by the Inflation Reduction Act (IRA).

With China’s economy also registering relatively robust growth of about 5%, there has been a slightly better-than-expected trade environment for other major economies, especially the EU (for which China and the US are the two biggest trade partners).

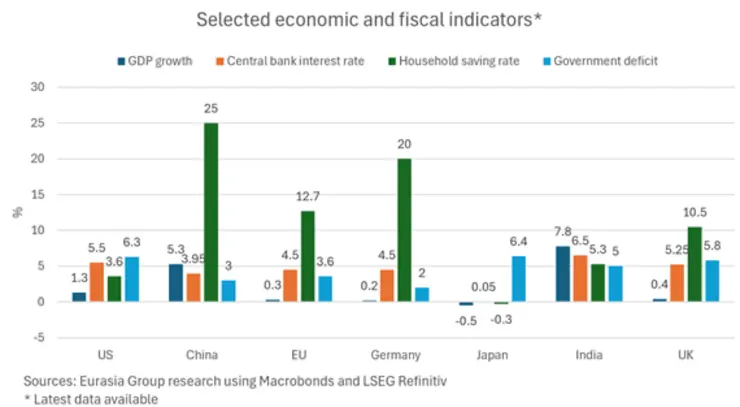

The EU, hit hard by Russia’s energy supply cuts since 2022, is showing signs of recovery as inflation (including energy costs) eases, and some policy initiatives like increased defense and industrial support spending is starting to have an impact. Consumer sentiment, however, remains weak. This is evidenced in high European household saving rates, which indicate that European citizens are weary about their future finances amid ongoing high costs and the Ukraine war showing no signs of abating. The European Central Bank may become the first of the major central banks to cut interest rates in the second half of the year, as EU inflation has fallen faster than in the US (albeit from higher levels). Overall, Europe’s economies (including its largest, Germany) have likely exited the economic trough that was late 2023 and early 2024. Comparatively low debt levels and high household saving rates, at least in theory, would allow the bloc some more upside, should sentiment improve, and lawmakers and regulators enable more growth-oriented policies.

Outside the Big-Three economies (US, China, EU), fears earlier this year that higher interest rates and a strong US-dollar could cause severe fiscal distress in emerging markets have also yet to materialize, as many governments have taken measures to reduce their exposure to dollar-denominated imports like commodities. This is perhaps best visible in India, the world’s leading emerging market economy, and where GDP growth remains strong (7.8%), even amid relatively low growth in commodity imports and despite the geo-economic and geopolitical headwinds.

Just as the worst economic predictions have so far not materialized in 2024, some of the bigger political concerns have also not happened (at least yet). Major, free elections have roughly been going as predicted, or at least not produced the worst possible outcome for businesses.

In India, Prime Minister Narendra Modi won a third term, although he lost his majority (which polls failed to predict). Still, the domestic election outcome and India’s strong geopolitical position (being wooed by the US and EU, maintaining strong relations with the Global South, while keeping up trade ties with Russia, especially in commodities) put the world’s most populous country in a strong economic and political position for the near future. Other major emerging markets, most notably Indonesia, have maintained steady political environments even amid power transitions.

In Europe, two elections will likely produce democratic change, the impact of which will heavily depend on the French parliamentary elections in late June/early July. June’s EU parliamentary elections have produced a shift from the center left to the center right, but largely avoided a strong push to the populist hard right in Brussels. However, France has called a parliamentary election for late June/early July, which may produce a far-right Prime Minister, which would make governing much more complicated for President Emmanuel Macron, with implications for the entire EU. Overall, however, the EU’s strong green industrial transition will likely continue, although more conservative industrial and economic policies aimed at improving the bloc’s competitiveness and strategic independence will likely be pushed ahead from the fourth quarter of 2024 onward (e.g. attempts for more business-friendly regulation, increased defence spending, re-shoring of industries like battery manufacturing, material processing, semi-conductor making, increased infrastructure spending). The Antwerp Declaration will likely provide the blueprint for such an initiative. In the UK, the election of 4 July will almost certainly result in a government change and strong majority for a Labour government. Given France’s uncertain outlook and Germany’s weak coalition, this means Britain – in a flip from its recent past - will probably be one of Europe’s only major nations with a strong mandate in coming years. Although the party says it will continue with relatively conservative spending policies, Labour will try to introduce policies that produce some growth, especially in union-heavy sectors like steel and chemical making, as these support its voter base and provide potential jobs in regions outside London that have been long neglected by the incumbent Conservative Party. Although limited by fiscal constraints, Labour will probably launch a green and industrial policy in combination with a rapprochement with the EU especially in the areas of energy and industry (including carbon policy alignment).

Overall, the economic conditions in the Big-Three economic regions have either performed better than expected during the first half of 2024 (US), or they have remained stable (China) or slightly improved versus late 2023 (Europe). Politically, China remains stable, Europe (EU, UK) has seen relatively uncomplicated elections despite the populist surges, while the US is about to enter the hot phase of the most aggressively contested Presidential elections in its history.

The Bad

The upcoming US elections are among the world’s biggest political risks for the second half of 2024 (along with the ongoing conflicts in Ukraine and the Middle East, see further below).

The US election is, at this stage, too close to call (Eurasia Group currently gives contester Donald Trump a slight edge over incumbent Joseph Biden), but it comes amid major geopolitical and macro-economic risks, and the outcome itself would likely amplify some of these.

Risk factors for incumbent Biden include:

- Developments in the Middle East: President Biden faces a conundrum in that progressive voters criticize him for being too soft on Israel’s invasion of Gaza, while right-leaning voters reject most criticism of Israel.

- Developments in Ukraine: Ukraine’s military is struggling to push back a Russian offensive. To be more successful will require more Western military and financial support, possibly further escalating the war during the third and fourth quarter, which would fall into the timeline of the US elections in November. Support for Ukraine has significantly waned among conservative US voters, at least some of which Biden needs to prevent them from voting for Trump, who boasts that he would quickly end the Ukraine war by finding a deal with Russian President Vladimir Putin.

- A slowing US economy and rising fiscal stress: Although the US economy has outperformed expectations in the first half of the year, it has over the second quarter shown signs of slowing down. Interest rates may well remain at current, high levels for the rest of the year, dampening consumer sentiment, while low saving rates may further force back consumer spending. Many economists now forecast US GDP growth to drop below 1% in the second half of the year, which would pull it down to similarly stodgy levels experienced in Europe (though that region is hoping for an acceleration to such tepid growth levels). Should US growth stall just ahead of the elections, that would likely make Biden’s re-election bid more difficult still. Meanwhile, the poor US fiscal situation shows few signs of abating. Amid ongoing high interest rates, it is possible that the US in 2024 will, for the first time in its modern history, pay trillion just to serve its debt interests. That would put its debt interest payments above its enormous defense budget, also a first. Whoever wins the US election will face difficult fiscal decisions in 2025, possibly while struggling to regain lost economic momentum.

Risk factors for Trump include:

- Trump’s ongoing court cases: While his conviction over the adult firm star hush money process has not dented support from his core, it may prevent more moderate conservatives from voting for him. As his legal battles will continue throughout the election campaign, this poses a major risk for Trump’s re-election campaign.

- Abortion: The Republican Party’s anti-abortion stance has caused a major backlash among female US voters, which many analysts say is not properly reflected in current polling. It is not impossible that Trump will come out in favor of more relaxed abortion rights. However, that would risk alienating his conservative voter base.

- An ongoing resilient US economy: Just as an economic slowdown would probably hurt Biden’s re-election prospects, an ongoing resilient US economy (e.g. falling inflation/interest rates, full employment, stabilization of GDP growth rates) could hurt Trump’s bid, if Biden can credibly point to his strong economic credentials.

- A sudden de-escalation in the Middle East and/or Ukraine: Though unlikely in Eurasia Group’s view, a sudden and therefore unexpected de-escalation of either or both the world’s major conflict zones would undoubtedly help Biden’s re-election effort as it would strengthen his geopolitical credentials and would almost certainly also help significantly bring down inflation (through lower energy prices).

In China, economic momentum is also stuttering. While the country has so far managed to avoid a severe slowdown that many observers (especially in the West) expected for 2024, it is also true that Beijing has so far failed to inject new momentum. Consumer sentiment is weak, with a growing public sense that the pre-2020 boom years will not return. That’s because China’s post-Covid socio-economic conditions have changed in fundamental ways compared to those that dominated the decade running up to 2020:

- China’s population peaked during the pandemic, and has since gone into decline, sapping its economy of key growth momentum.

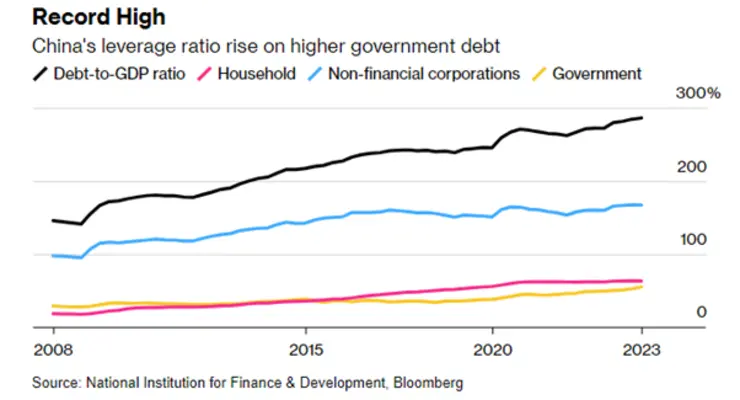

- China’s state, private, and corporate debt rate has skyrocketed (see chart below), depriving the government of past opportunities to use large fiscal packages to stimulate the economy, while exposing the country’s companies and private consumers to higher debt (and interest) payments, undermining sentiment.

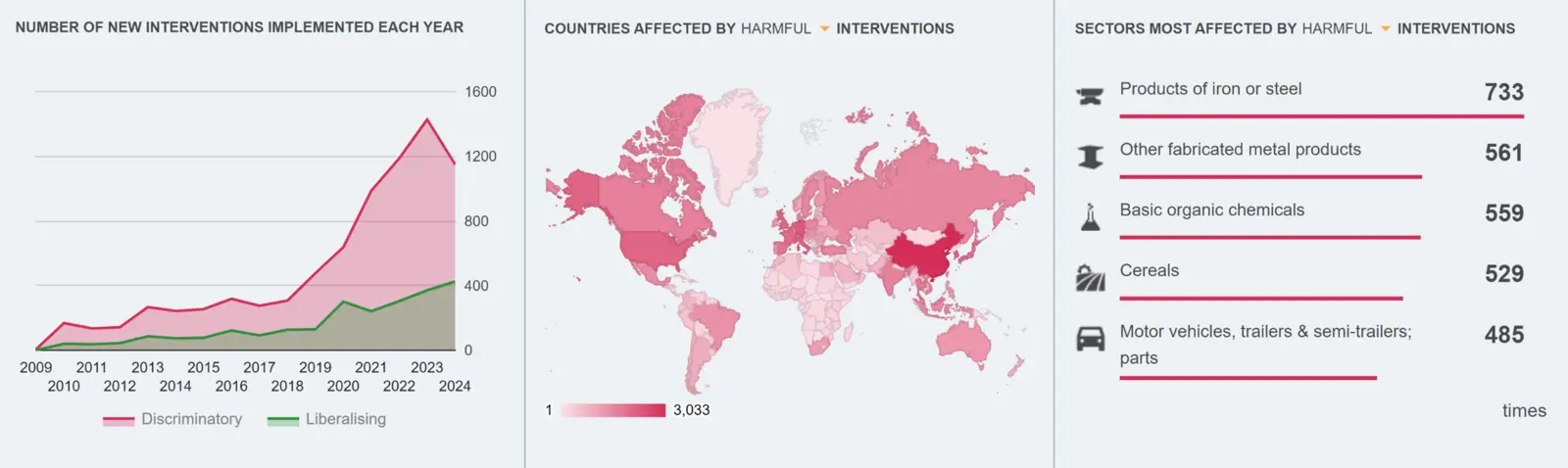

- China’s vast overcapacity stretches across virtually all sectors (e.g. construction, steelmaking, chemical and petrochemical, auto manufacturing, solar panels, textiles, oil refinery products). This makes big stimulus programs less effective, and in many cases even prevents them (especially in construction). It also erodes prices and profits for its companies, many of whom have turned to exporting excess goods at low prices into the world market (known as dumping). This provides them with little relief and often forces layoffs (as seen in high youth unemployment rates, estimated above 20%), and causes global trade disputes which have contributed to rising tariffs globally.

In Europe, the slightly improving economic outlook remains fragile and prone to outside shocks. Growth could be stalled globally, especially as the EU is the world’s most trade reliant major economy, meaning that a slowdown in China and/or the US would risk derailing the EU’s own recovery. A further escalation of the wars in Ukraine and the Middle East would also impact Europe’s economies more than others through its proximity and support of Ukraine as well as reliance on oil and gas imports from the Middle East through the Red Sea. Domestic factors are also a risk, including a stalling reform agenda and more trade protectionism (e.g. electric vehicle tariffs on China). A French parliamentary election that produces a Prime Minister in opposition to the incumbent President (known as cohabitation) could undermine the EU’s ability for consensus-making, on which it relies to make decisions. And while there are no more major national elections in the EU scheduled for 2024, regional German elections are expected to result in a far-right populist surge that could impact national elections in 2025.

For India, the economic and political outlook for the second half of the year may also deteriorate, although Eurasia Group maintains the view that at least India will continue to grow strongly. Drag factors include increasing trade protectionism, ongoing high interest rates, a strong US-dollar amid longer-for-higher interest rates, as well as a slower domestic reform agenda following Modi’s loss of an outright majority, which will force him to make compromises which will likely stall some economic reforms including regional permitting.

Similar factors pose even bigger risks to other, smaller emerging market economies, especially in South and Southeast Asia. If these regions face bigger socio-economic pressure in the second half of 2024, that could also spill into more headwinds for India.

Overall, the global headwinds that may stall the better-than-expected performance witnessed in the first half of 2024 should be manageable provided they are not compounded by further internal or external shocks (see next section).

The Ugly

The ongoing wars in Ukraine and the Middle East continue to pose by far the greatest risks to the world’s economic and political stability.

Worryingly, neither shows major potential for a credible de-escalation:

- While a ceasefire in the Middle East is possible as global (and especially US) pressure builds on Israel to dial down its military operations, the extraordinarily high civilian losses in Gaza have triggered a surge in hostility against Israel in the Middle East and by the global Muslim population (and many Western progressive voters). With Israel’s public also opposed to an agreement with Hamas, a genuine stabilization of the Middle East is unlikely in the near future. This is compounded by Iran’s volatile relations with the outside world (especially the US) and by the political uncertainty stemming from November’s US elections.

- In Ukraine, even the recently approved major US ( billion) and EU ( billion) support packages will not likely enable Kyiv to push Russia’s military out of its territory. The support will, however, probably be strong enough to prevent Russia from breaking through Ukraine’s defenses and making another push for its capital Kyiv. That means the Ukraine war will likely enter a third winter by the end of 2024, causing huge and mounting human, economic, and geopolitical damage. There also remains a risk of a further escalation as Western powers provide Ukraine with more means to strike within Russia, possibly triggering a strong retaliation by Moscow. Overall, the reality for all of Europe is that the entire region will be unable to return to fully normal economic (e.g. high energy prices, risk of supply disruptions), financial (e.g. huge fiscal support packages), and political conditions (e.g. hostile relations with the EU’s biggest neighbor) until the war in Ukraine is resolved. With China refusing to even act as a restraining force on Russia’s aggression, and it being increasingly clear that Beijing supports so-called dual-purpose support (supplying officially civilian goods and investment, which can be used for military purposes), there is also a risk of a further deterioration of EU/Chinese relations. Given this is the world’s biggest single trade relationship, such a deterioration would pose significant economic risks to the global economy. To a lesser extent, any too openly pro-Russian moves by India could also cause a backlash in Europe, slowing or stalling negotiations over trade, investment, movement of people, or defense.

Beyond the humanitarian losses, the Ukraine and Middle East wars have already caused immense global economic damage, especially through spikes in energy costs which were the main driver for surging inflation of 2022/23. Although energy prices have come off since then, current costs for oil, gas, and coal remain too high for the relatively weak global economy. And although extreme price spikes and supply disruptions as seen in 2022/23 are unlikely to repeat at that scale, smaller scale disruptions and price jumps remain possible and could undermine the already weak global economy.

The two wars also further deepen the geopolitical divides:

- Europe and the US increasingly see China as a hostile actor in Ukraine. This risks spreading anti-Chinese public and political sentiment in Europe, pushing it toward more aggressive trade action as seen in the US, where animosity toward China is already cross-partisan. To a lesser extent, this is also a risk for India.

- Ongoing US and European political support for Israel, meanwhile, significantly undermines its credibility with large parts of the Muslim world and the Global South, where pressure to defeat Russia but support for Israel’s actions in Gaza are seen as two-faced.

Conclusions

Despite the high degree of geopolitical uncertainty and risk, there are some basecase (i.e. most likely) prospects for the second half of 2024. These include some constructive trends but also significant risks:

- India: a stable economic and political environment, but a slowdown in economic reforms following Modi’s lost majority, as well as ongoing high fiscal pressure from a strong dollar due to higher-for-longer interest rates. India will continue to have stable and constructive relations with the US and Europe, but with a tail-end risk of cooling relations due to possible fallouts related to the Ukraine war.

- Europe: a slight improvement of EU and UK economic conditions is likely in the second half of the year as the energy crisis abates and political changes are modest (shift to the center-left in UK, shift to the center-right in the EU). Changes in the EU will probably result in an industrial policy initiative by the end of 2024, aimed at improving economic competitiveness via lighter regulation and industrial incentive schemes (e.g. Antwerp Declaration and Reboot Europe initiatives). The EU’s increased defense spending will also lead to more demand for energy-intensive goods (e.g. steelmaking, metals processing, and chemicals production), while support schemes for de-carbonization of such goods will likely remain relatively stable and strong.

- US: economic growth will likely slow in the second half of the year, but it has good chances to prevent a full stall or even a recession in 2024. The biggest risk from the US stems from the close but deeply divisive US election in November, which could have a major stabilizing impact on 2025 (Biden re-election) or become a major factor of political risk and volatility (Trump win). In terms of international trade tariffs, it is worth noting that both Biden and Trump have shown strong protectionist instincts (Biden didn’t roll back previous Trump tariffs, introduced new barriers on China, and launched the protective Inflation Reduction Act, while Trump would likely raise new and broad import tariffs). US fiscal stress will become a major issue in 2025.

- China: Beijing will continue to face challenging domestic economic conditions (e.g. low probability of a construction revival and large-scale industrial overcapacity), which hamper domestic demand while possibly flooding the global market with surplus Chinese products. Politically, China’s relations with the US have recently stabilized (i.e. not deteriorated further), although Biden’s tariff offensive will undoubtedly trigger a Chinese response. China will continue to test and pressure Taiwan, but it will likely try to avoid open conflict. Meanwhile, Beijing’s relations with the EU are on a tipping point. Any further support acts for Russia could tip the EU into more aggressive trade and diplomatic action (more like that of the US), while a more cautious stance by China could lead to a return to more pragmatic and trade-focused EU/China relations.

Overall, the global economy performed better than expected during the first half of the year. While there is a risk that the initially expected slowdown is only delayed into the second half, there is a decent likelihood that an overall deterioration can be avoided, with a US slowdown being offset by some European recovery, relatively stable Chinese conditions, and ongoing strong growth in India (declining inflationary pressure and the receding energy crisis are probably the biggest supporters of this trend). Geopolitically, the conflicts in the Middle East and Ukraine remain sources of high risk of escalation (which risks derailing global economic growth and further deepening the divide between the West and China, but also the Global South). While de-escalation initiatives (e.g. a Gaza ceasefire, or some form of Ukraine talks) could provide short-term humanitarian and economic relief (esp. via lower energy prices), the deep divides of all direct and indirect conflict parties as well as political uncertainties (especially related to the US election) mean a full and credible resolution of the Middle East and Ukraine conflicts remains unlikely for 2024.

~ The views represented in this blog post do not necessarily represent those of the Brandt School. ~

About the Author

Henning Gloystein is Eurasia Group’s Practice Head for Energy, Climate, and Natural Resources, based in London, and a Senior Fellow at the Brandt School. At Eurasia Group, he covers geopolitical risk in energy and raw material supplies, the transition from fossil fuels to renewable energy, as well as green industrial trends. Prior to returning to London in 2021, Henning was based in Singapore for seven years, covering the rise of the Indo-Pacific region as the world’s biggest consumer of natural resources. Before joining Eurasia Group in 2019 as a Director, Henning was Editor in Charge for Energy in Asia at Reuters news agency. Henning started his career in energy analysis at commodity pricing agency Platts in 2007, where he was responsible for pricing European wholesale power, natural gas, coal, and carbon markets. Henning has a dual Master’s Degree in History, Politics, and Science & Technology from Humboldt and Technical University in Berlin. Half British/German, he lives near Oxford with his family.